Summary

- Q2 performance was unremarkable with 2% higher revenue YoY, primarily due to the acquisition of Speedpay.

- Organic growth was negative due to decline in transactions, impact of COVID-19 on On Premise business, and the shift in tax payments.

- Despite the negative growth, I expect that ACI Worldwide performance will improve as the economy recovers.

- Transaction volume is expected to grow by 11.5% CAGR until 2024.

- The company is focusing on high-growth areas, including real-time payments and emerging markets.

- Looking for a portfolio of ideas like this one? Members of Digital Transformation get exclusive access to our model portfolio. Get started today »

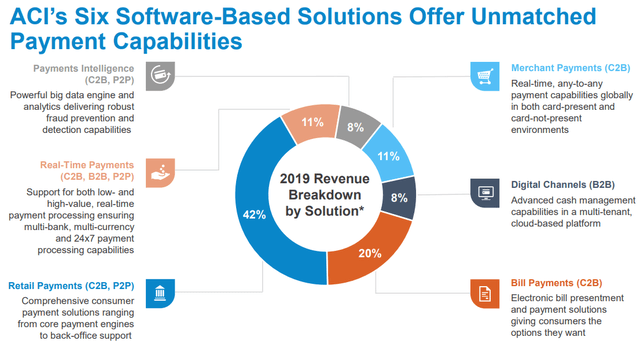

(Source: ACI Worldwide)

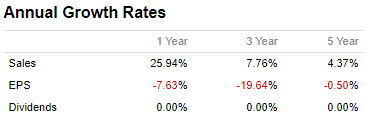

ACI Worldwide, Inc. (ACIW) is a digital payments company that provides services in the Americas, Asia/Pacific, Europe, Middle East, and Africa. The company’s performance in recent years has been unremarkable, to say the least. Its 5-year revenue growth rate is 4.4%, pretty anemic compared to most of the software companies that I track.

(Source: Portfolio123)

The Q2 2020 YoY revenue growth was a measly 2%, and that was only due to last year’s acquisition of Speedpay. Ignoring that acquisition, revenue declined by 10%, primarily due to the impact of COVID-19. On the bright side, billings increased by 6% YoY and total recurring revenue grew by 4% YoY.

Despite the subdued performance, I believe that ACI Worldwide will be a good investment going forward given the stock’s low price, large contractual backlog ($5.8 Billion over the next 60 months), expected increase in transaction volume, and a new high-growth opportunity.

Due to lack of inspiring historical performance, the company sports a price/sales ratio of 2.31, well below the software industry average of 7.31. This alone is one very good reason for owning this stock: there is likely more price upside potential than downside risk.

The long-term backlog of $5.8 billion provides financial stability in this uncertain economic environment.