Summary

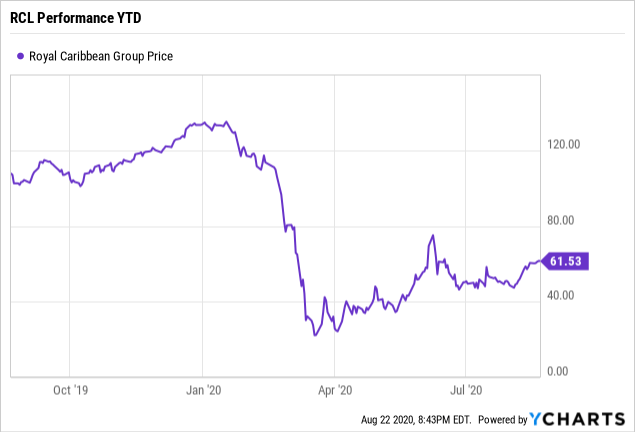

- The day before the COVID market selloff (2/19) RCL shares were trading at $111.19, citing a 37.54% slide to today.

- Shares are already up 222% from their 52-week low.

- CruiseCompete.com saw a 40% increase in its bookings for 2021 over its 2019 bookings, citing for post-pandemic strength in demand.

Investment Thesis

Royal Caribbean (RCL) is poised for tremendous growth in 2021 and 2022. Demand for cruises has skyrocketed, with bookings for 2021 surging in demand. Royal Caribbean is offering multiple discounts for cruisers which further encourages consumers. Royal Caribbean is the best positioned major cruiser for the post-pandemic era in the industry due to its strong balance sheet, fleet makeup, and public opinion. The company’s joint ventures will recover in tandem with the cruise industry recovery, will bring Royal Caribbean to the top of the line of cruisers.

Company Overview

Royal Caribbean is the second larger cruiser in the world. They own and operate 61 ships with their partner brands sailing to 1,000 destinations on all 7 continents. Their partner brands include Celebrity Cruises, Azamara, and Silversea Cruises. Locations are concentrated in the Caribbean, Asia, and Australia during the Northern Hemisphere’s winter weather. Royal Caribbean and its subsidiaries have capacity for approximately 149,320 berths across all ships. There are 17 ships on order, expecting to enter service from Q3 2021 through Q3 2024; totaling 55,300 berths.

Data by YCharts

Data by YChartsI wanted to include the performance of Royal Caribbean to emphasize the steady growth for the pre-pandemic period. After the volatility subsides, I believe the company will have the same steady growth for a prolonged period of time (unless there is another pandemic of course).