Summary

- The just released Q1/2020 Darden earnings show solid sales growth and stable margins.

- Darden confirmed its full-year outlook despite industry weakness.

- Long-term I still like this company, but I won't be trading it for now.

I am a big fan of Darden Restaurants (DRI). Not only because of its food or phenomenal track record, but because the company is a great tool to track consumer sentiment. Where do consumers go when wages go up and the economy strengthens? They go out to eat and enjoy themselves. Darden has been a great beneficiary of this since the end of the recession and just reported another quarter of strength. The company is doing good. Unfortunately, Darden is mentioning unexpected weakness in its business environment but remains confident that full-year targets are achievable. All things considered, Darden continues to be one of the better consumer stocks, but consumer strength needs to be monitored as it has the potential to do a lot of damage.

Source: Darden Restaurants

Unfortunately, Momentum Matters

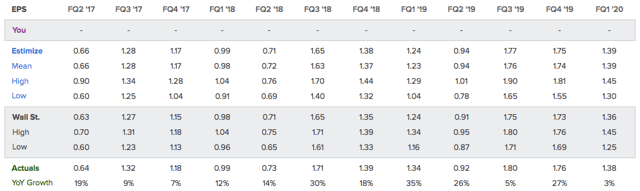

Let's start with the number everyone cares about: adjusted EPS. The first quarter of 2020 fiscal year came in $0.02 above expectations at $1.38. The company has not missed expectations in years and has done tremendously well. The Q1 growth rate unfortunately hits a new cycle low of just 3% which is a significant decline compared to previous quarters.

Source: Estimize

Source: Estimize

The good news is that sales growth continued to do well. Total sales improved by 3.5% which is more or less in line with previous quarters. This growth rate was provided by 2.6% growth from 40 net new restaurants and same-store sales growth of 0.9%.

CEO and president Gene Lee mentioned something I found very interesting and worrisome, to be honest.

The industry comping negative is surprising considering unemployment remains at all-time low and there continues to be strong wage growth, which historically has been a positive for the industry.

Before I show you the bigger picture, let's look at some key data. Olive Garden reported its 20th consecutive quarter of higher same-restaurant sales. Total sales were up 3.6% while same-restaurant sales improved by 2.2%. The total number of Olive Garden restaurants increased by 1.4%. Olive Garden outperformed industry comparable-store sales by 340 basis points, according to Darden which is the largest gap since the first quarter of fiscal year 2019. Unfortunately, traffic was down slightly as a result of changes in first-quarter promotions and weakening industry demand.