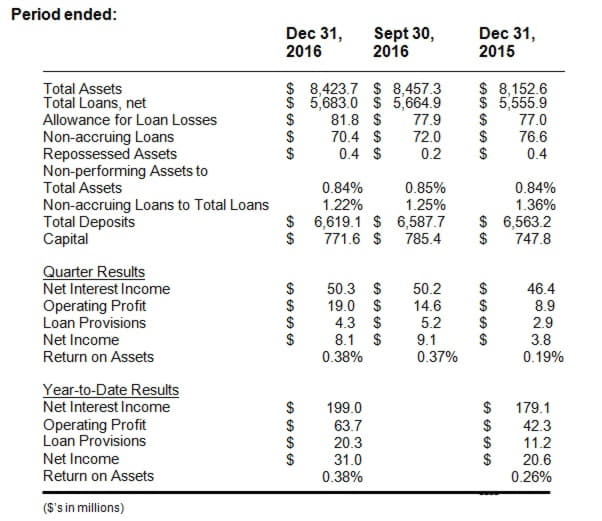

Mercantil Bank, the fourth largest commercial bank headquartered in Florida and among the top 2% of banks nationally ranked by asset size, today announced a net profit of $8.1million and total assets of $8.4 billion for the quarter ended December 31, 2016.

Net interest income for the quarter was $50.3 million, 8.4% higher than the same quarter last year and approximately the same as the previous quarter. Operating profit for the quarter was $19.0 million, 113.5% higher than the same quarter last year and 30.1% higher than the previous quarter.

As to the Bank’s results for the fourth quarter of 2016, real estate loans grew 2.0% from the previous quarter, and 24.0% over the last twelve months. This growth is the result of the Bank’s continued focus on economic development in key sectors where it does business, most notably the real estate sectors in South Florida; Houston, Texas; and New York.

The Bank’s capital closed at $771.6 million, and its capital ratios continue to significantly exceed the regulatory benchmarks to be considered “well capitalized.” At December 31, the Bank’s Tier 1 Leverage Ratio was 9.2% and the Total Risk Weighted Capital Ratio was 12.4%.

The Bank maintains a significant portion of its assets, $2.2 billion or 26.5%, in highly liquid short-term placements and a securities portfolio primarily comprised of bonds issued or guaranteed by U.S. Government Agencies and Sponsored Enterprises and high-quality corporate bonds. This high level of liquidity positions the Bank to continue supporting its lending activities.

“We are pleased with our performance during the fourth quarter, as we were throughout the year. We achieved our deposit and asset targets while continuing our loan diversification strategies,” said Millar Wilson, Vice-Chairman and CEO of Mercantil Bank. “Enhancing our customer service experience is a major focus for us. In 2016, we launched new Personal Online Banking and Mobile Banking platforms that delivered easier navigation and enhanced functionality for our customers. In 2017, we will remain committed to delivering exceptional customer service and expanding our product offerings as we continue to grow in South Florida, Texas, and New York,” added Wilson.

ABOUT MERCANTIL BANK:

Mercantil Bank, N.A. is one of the largest banks in South Florida serving its community for over 35 years. Mercantil Servicios Financieros (MSF), a Venezuelan holding company, beneficially owns the Bank through U.S. bank holding companies. MSF is the largest provider of financial services in Venezuela with more than 90 years of experience. Mercantil Bank has assets of $8.4 billion. The Bank is headquartered in Coral Gables, Florida and has 22 Banking Centers - 15 located in South Florida and 7 in Houston, Texas, as well as 1 loan production office in Manhattan, New York. The Bank offers a wide variety of domestic, international, personal and commercial banking services, including investment, trust, and estate planning through its subsidiaries, Mercantil Investment Services, Inc. and Mercantil Trust Company, N.A. For more information, please visit www.mercantilcb.com.